The Bitcoin Dollar ecosystem is creating something unprecedented in crypto: a way to earn consistent yield on Bitcoin while dramatically reducing volatility. And FISC is the governance token that puts you in the driver’s seat of this entire protocol.

If you believe Bitcoin yield products are about to explode in popularity, FISC offers a way to own the infrastructure powering that growth.

First, What is Bitcoin Dollar (BTCD)?

Before diving into FISC, you need to understand the product it governs.

Bitcoin Dollar (BTCD) is a crypto token that gives you half the Bitcoin exposure with built-in yield. It’s designed to solve Bitcoin’s biggest adoption barrier: volatility.

The concept is simple:

- If Bitcoin goes up 20%, BTCD goes up ~10%

- If Bitcoin falls 10%, BTCD falls ~5%

- You earn yield on your holdings by staking BTCD

BTCD maintains a 50/50 mix of Bitcoin and USD through automated rebalancing, giving you Bitcoin upside with smoother price swings. Meanwhile, the protocol generates yield from multiple sources: funding rate arbitrage, DeFi lending, liquidity provision, and treasury allocations.

Backtesting suggests up to 6% annual yield on total assets, with potential for more through diversified strategies.

Two versions serve different users:

- BTCD: Simple, liquid Bitcoin exposure for mainstream users

- sBTCD (staked BTCD): Higher yields for DeFi users who stake their tokens

Think of BTCD as Bitcoin exposure that’s easier to hold through market swings. It offers exposure to Bitcoin’s long-term trend without the full volatility ride.

What is FISC?

FISC governs the Bitcoin Dollar ecosystem. While BTCD (Bitcoin Dollar) is the product users hold to get reduced-volatility Bitcoin exposure with yield, FISC represents ownership and control of the protocol itself.

As Bitcoin Dollar products attract assets and generate yield, FISC holders capture value through governance-directed revenue sharing and control over critical protocol economics.

What Does FISC Do?

FISC gives tokenholders three core capabilities:

1. Governance Rights

FISC holders control the protocol’s key parameters:

- Fee allocations between the operating entity, sBTCD stakers, and FISC holders

- Decisions about how yield is distributed (i.e. dividends)

- Protocol expansion decisions (launching ETH Dollar, Solana Dollar, etc.)

2. Revenue Share

Through governance decisions, FISC holders can direct a portion of net protocol revenue to themselves. The protocol generates revenue from:

- Funding rate arbitrage (spot-long/perp-short basis trades)

- Lending protocol yields (Aave, Morpho, Euler)

- LP fees from AMM positions (Uniswap, Curve)

- Stablecoin yield and Treasury allocations

- Options premium collection

Backtesting suggests the protocol can generate up to 6% annual returns on total AUM. As assets scale, the pool available to FISC holders grows.

3. Expansion Optionality

The Bitcoin Dollar infrastructure can power adjacent products like ETH Dollar, SOL Dollar, or Gold Dollar. Each new product increases total AUM and protocol revenue, expanding the value pool that can accrue to FISC holders without diluting the token supply.

FISC Value Proposition

The thesis is straightforward: as Bitcoin Dollar products gain adoption and accumulate AUM, FISC holders capture the economics of that growth.

Here’s what makes the opportunity compelling:

Massive Market Opportunity:

- Bitcoin’s $2.4 trillion market cap remains largely unyielding

- Leading crypto asset managers often only offer up to 1-2% APY on BTC vaults

- Bitcoin Dollar targets double-digit yields through diversified DeFi strategies

- Retail demand is proven: Ethena scaled to $16B AUM with a $9B governance token valuation

Direct Value Accrual Mechanism: At launch, 5% of net protocol yield on BTCD’s total AUM will be used to buyback and burn FISC tokens, creating deflationary pressure on supply.

Multiple Revenue Streams: Unlike competitors dependent on single strategies (like Ethena’s reliance on ETH funding rates), Bitcoin Dollar diversifies across funding arbitrage, lending, LP fees, and stablecoin yields, creating resilience when any single source underperforms.

Built-In Distribution: The go-to-market strategy leverages established crypto asset managers (collectively managing $10B+ AUM) and CEX “Earn” platforms, providing institutional-grade distribution without the cold-start problem.

Team Execution: The founding team has collectively managed billions in crypto capital, built automated trading systems, launched regulated crypto products, and maintained deep DeFi relationships. This isn’t a concept. It’s being built by people who’ve already done it.

How to Get FISC

FISC is currently available through a token pre-sale at $0.01 per token, implying a $100 million fully diluted valuation.

Timeline:

- Q4 2025: BTCD launches pre-sale on Coinme

- Q1 2026: FISC becomes liquid and available on DEXs and CEXs (targeting Uniswap, Coinbase, Binance)

- Q2 2026: BTC yield vault launches

- Q3 2026: Governance initiates revenue sharing to FISC stakers

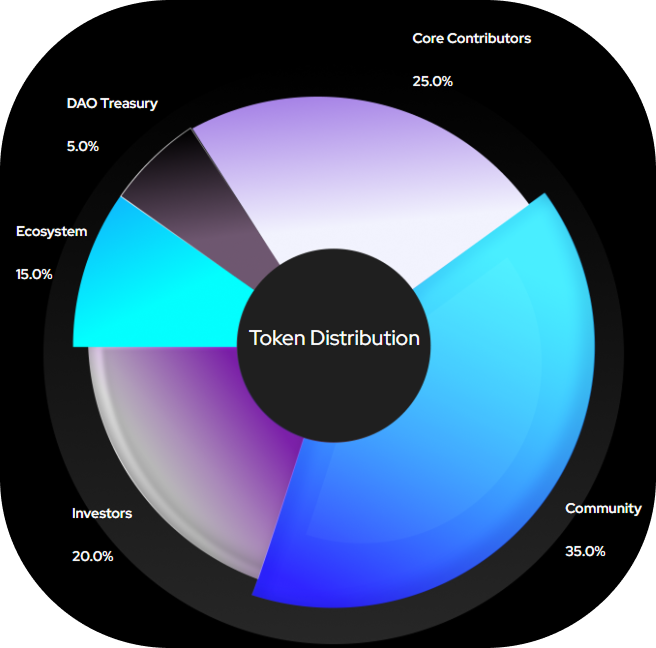

Token Distribution

Community Allocation (35% of supply)

Team (25%)

Investors (20%)

Ecosystem Development (15%)

DAO treasury (5%)

The Bottom Line

Bitcoin yield remains massively underdeveloped. Institutional custody is mature, DeFi primitives are battle-tested, and regulatory clarity is improving. The timing is right for a product that combines yield, accessibility, and reduced volatility.

FISC offers a way to own the economics of that opportunity. As Bitcoin Dollar becomes a leading engine for Bitcoin yield products, FISC becomes the default way to own the platform’s cash flows.

If you believe Bitcoin’s next wave of adoption will come from yield-seeking capital rather than price speculation, FISC deserves your attention.

Learn more about FISC here or the Bitcoin Dollar protocol.

Labs is acquiring Coinme to power the Open Money Stack.

Labs is acquiring Coinme to power the Open Money Stack.